Procuring Lab Supplies Internationally to Save Money

Everyday researchers use Lab Spend to find savings on the products their lab needs.

We’ve discussed basics on how to save on lab supplies if you want to negotiate with supplier and manufactures. However, today we want to discuss a technique that most labs don’t consider which is to order internationally. We’re based in the USA therefore in this example we will explore buying items in Canada.

Currently the exchange rate between US dollars (USD) and Canadian dollars (CAD) is 1.29.

This means that if a supplier is offering a product for $10 in the USA then it should cost $12.90 in Canada, but this is not always the case. Scientific suppliers list products with significant pricing discrepancies even when you consider exchange rate.

Let’s look at some examples:

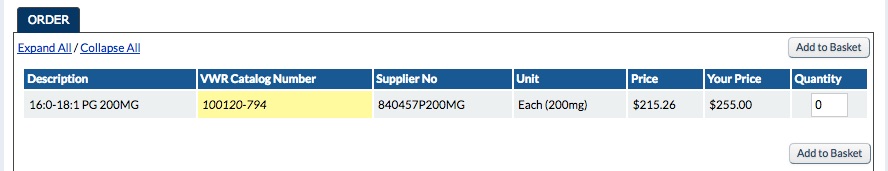

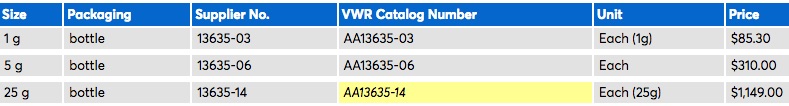

VWR is offering Holmium triiodide, 25 grams for $1,149 USD therefore it should be $1,482.21 in CAD.

As you can see, if you are based in Canada then you would paying about 35% more or $636.05 than the exchange rate would suggest verse ordering in the USA.

This chemical is also non-hazardous therefore the shipping cost will not make up the difference.

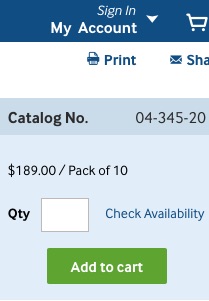

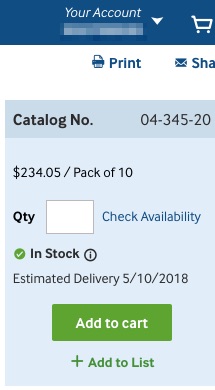

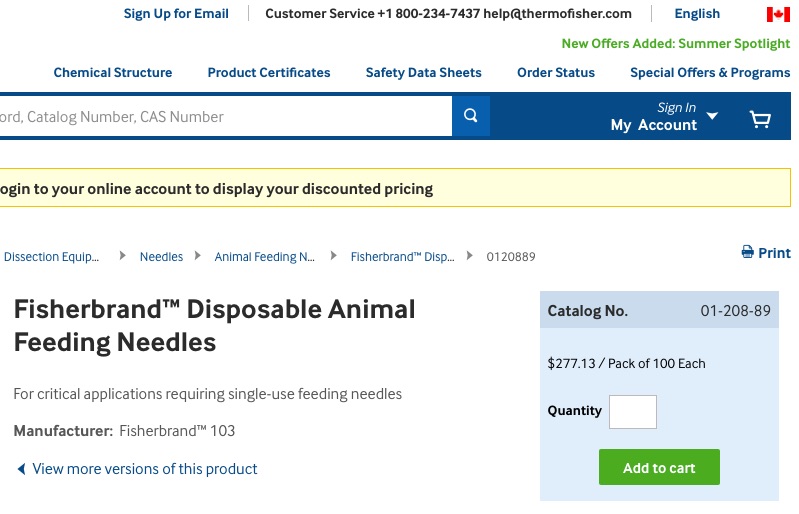

Fisher Scientific offers Disposable Animal Feeding Needles that have a list price of $410 USD using the exchange rate this product should sell for $528.90 CAD.

However, this product has a list price of only $277.13 CAD, which is $214.44 USD. The savings when comparing the item in USD would be $410 verse $214.44 resulting in a savings of $195.56 or about 63%.

In these examples, we are comparing list prices which may differ from your account price. We are excluding shipping costs, but the savings can more than make up of the difference. As a reference, a package that ships ground within the USA for $15 would be about $35 to Canada.